Why Phones Are Turning into Cars: The boundaries between our digital devices and physical transportation are dissolving in ways that would make Charlie Brooker, creator of the dystopian series Black Mirror, nod knowingly. We’re witnessing an unprecedented shift where companies that once specialized in putting powerful computers in our pockets are now building the vehicles we drive. This convergence isn’t just technological evolution—it’s a fundamental reimagining of what a car can be, raising questions about privacy, control, and the future of human mobility.

The Smartphone-to-Steering Wheel Pipeline

The transformation began quietly, but the evidence is now undeniable. Xiaomi, the Chinese electronics giant known for affordable smartphones, delivered over 135,000 of its SU7 electric sedans in 2024 alone, targeting 300,000 deliveries in 2025. This isn’t a side project or experimental venture—it’s a full-scale automotive operation that has caught traditional automakers off guard.

The SU7 represents more than just another electric vehicle entering an increasingly crowded market. It achieved the official lap record for a four-door car on the Nürburgring Nordschleife at 6:46.874, driven by racing driver David Pittard, proving that phone companies can create vehicles that compete with established performance brands. More telling, the waiting time for the SU7 Pro extends 43-46 weeks, essentially selling out the model for 2025, demonstrating genuine consumer demand.

But Xiaomi isn’t alone in this transformation. Companies like Huawei, Apple, and others have announced or explored electric vehicle programs, with Xiaomi committing $10 billion to its EV program over the next decade. The tech industry’s invasion of automotive space represents a seismic shift that challenges everything we thought we knew about car manufacturing.

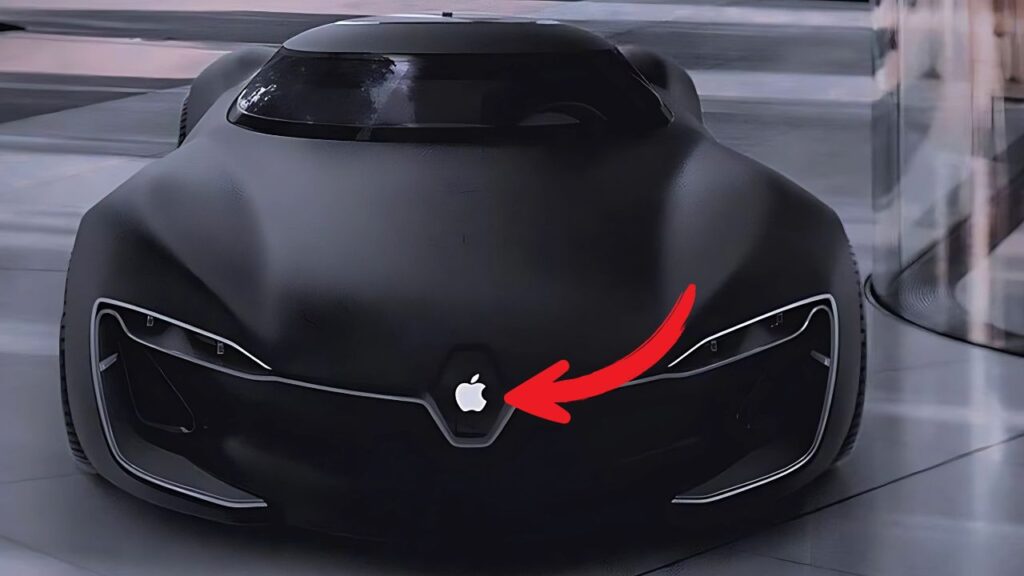

The Apple Car That Never Was

Perhaps no company embodied the potential and pitfalls of this convergence more than Apple. From 2014 until 2024, Apple undertook a research and development effort to develop an electric and self-driving car, codenamed “Project Titan,” with around 5,000 employees reportedly working on the project as of 2018.

The project represented the ultimate expression of tech companies’ automotive ambitions. Apple was targeting 2024 for production and developing breakthrough battery technology that could include more active material, potentially giving cars longer range. The company’s approach to batteries was described as “next level” and “like the first time you saw the iPhone” by sources familiar with the project.

However, on February 27, 2024, Apple executives made an internal announcement that the entire car project was being cancelled, with most resources moving to work on Apple’s generative AI projects. The cancellation sent shockwaves through the automotive industry and raised questions about the viability of tech companies succeeding in the traditionally hardware-intensive car manufacturing business.

The Apple Car’s cancellation reveals the challenges tech companies face when transitioning from digital products to physical manufacturing. Unlike software, cars require massive supply chains, regulatory approvals, safety testing, and manufacturing expertise that even the world’s most valuable company found difficult to master.

Beyond Transportation: The Smartphone-on-Wheels Vision

What makes these ventures particularly intriguing—and potentially concerning—is how they’re redefining what a car represents. Traditional automakers focused on mechanical engineering, safety, and transportation efficiency. Tech companies approach vehicles as massive, mobile computing platforms.

The Xiaomi SU7 is equipped with a 16.1-inch touchscreen infotainment center with 3K resolution, powered by a Qualcomm Snapdragon 8295 system-on-chip and based on the Xiaomi HyperOS software. This isn’t simply adding technology to a car—it’s building a car around technology.

The implications extend far beyond entertainment systems. The SU7 includes a driver-assistance system branded Xiaomi Pilot with 16 functions, using two Nvidia Drive Orin system SoCs. These vehicles collect vast amounts of data about driving patterns, locations, preferences, and behaviors—information that smartphone companies have built their business models around monetizing.

Consider the privacy implications. Your smartphone already knows where you go, what you search for, who you communicate with, and how you spend your time. Now imagine that same company building the vehicle you drive daily, with sensors monitoring not just your location but your driving habits, passenger conversations, and even biometric data through advanced seat sensors and cabin monitoring systems.

The Convergence Revolution

The movement of phone companies into automotive manufacturing reflects broader technological convergence. Modern electric vehicles are fundamentally different from traditional cars—they’re software-defined products where the most valuable components are often digital rather than mechanical.

This shift plays directly to the strengths of technology companies. While traditional automakers spent decades perfecting internal combustion engines, transmission systems, and mechanical reliability, tech companies developed expertise in battery management, artificial intelligence, user interface design, and integrated ecosystems.

Modern automobiles are heading down a similar path to smartphones in terms of technology and connectivity, potentially dealing with obsolescence and bloatware. Just as phones become outdated after a few years, cars built by tech companies may follow similar patterns, requiring regular updates and eventually becoming obsolete when companies stop supporting older models.

The economic incentives are compelling. Chinese smartphone giants recognize the importance of cars, making smart vehicles in a software-defined approach before the anticipated arrival of Apple’s vehicle products. They see an opportunity to create integrated ecosystems where your phone, home devices, and car all work seamlessly together, potentially locking consumers into comprehensive technology platforms.

The Black Mirror Implications

The dystopian concerns aren’t merely theoretical. When Charlie Brooker imagined futures where technology intrudes into every aspect of human life, often with unintended consequences, he might have envisioned scenarios remarkably similar to what we’re witnessing today.

Consider the data integration possibilities. A smartphone company that also builds your car has unprecedented insight into your life. They know when you leave home, where you work, where you shop, who you visit, and how long you stay. They can correlate this with your digital behaviors, creating profiles of extraordinary detail and commercial value.

The control implications are equally concerning. Mobile phone manufacturers counter security issues by regularly releasing updates, but there are limits to how long companies support older devices, typically two to five years. Applied to vehicles, this could mean cars becoming security vulnerabilities or losing functionality when companies decide to end support.

Furthermore, the precedent set by smartphone manufacturers regarding planned obsolescence raises troubling questions about automotive longevity. Will cars built by phone companies be designed to last decades like traditional vehicles, or will they follow the smartphone model of encouraging replacement every few years?

Reshaping Automotive Economics

The entry of tech companies is fundamentally altering automotive economics. Traditional car manufacturing required enormous capital investments in factories, supply chains, and dealer networks. Tech companies are approaching this differently, often partnering with existing manufacturers or developing new, more flexible production models.

Samsung is collaborating with Renault to develop a car through Renault Samsung Motors, leveraging Samsung’s expertise in sensors and radars. This partnership model allows tech companies to focus on their strengths—software, user experience, and integrated systems—while relying on established manufacturers for production expertise.

The speed of development is remarkable. Xiaomi launched the SU7 in late 2023 and secured over 50,000 orders in the first 27 minutes, demonstrating both the rapid development capabilities of tech companies and consumer appetite for technology-focused vehicles.

The Winner-Take-All Future

Perhaps most concerning is the potential for winner-take-all dynamics that characterize much of the tech industry. In smartphones, a few companies dominate globally, with limited competition and significant barriers to entry for new players. If similar dynamics emerge in automotive markets, we could see a small number of tech giants controlling not just our digital lives but our physical mobility.

The network effects are already visible. Apple’s CarPlay Ultra provides content for all the driver’s screens, including the instrument cluster, with dynamic options for speedometer, tachometer, fuel gauge, and temperature gauge. These integrated experiences create strong incentives for consumers to remain within single technology ecosystems.

As these companies expand their automotive offerings, they’re not just building cars—they’re constructing comprehensive mobility platforms that could become as essential and difficult to escape as current smartphone ecosystems.

Looking Forward: The Road Ahead

The convergence of mobile technology and automotive manufacturing represents one of the most significant industrial shifts of our time. While the technological possibilities are exciting—improved safety, better user experiences, and innovative features—the broader implications deserve careful consideration.

We’re witnessing the emergence of a future where the companies that control our digital communications also control our physical transportation. This consolidation of power over multiple essential aspects of daily life represents a level of corporate influence that would have been unimaginable just a decade ago.

The challenge for society is ensuring that this technological convergence serves human interests rather than merely corporate ones. As we navigate this transition, we must consider not just what these companies can build, but what kind of future we want them to build.

The Black Mirror isn’t science fiction anymore—it’s the reflection in our car’s touchscreen, powered by the same companies that know everything about our digital lives and are now learning everything about where we go and how we get there.

Frequently Asked Questions

Why are mobile phone companies suddenly interested in making cars?

The convergence stems from electric vehicles being fundamentally different from traditional cars—they’re essentially computers on wheels. Phone companies already excel at battery management, software development, user interfaces, and creating integrated ecosystems. As cars become more software-defined, tech companies see an opportunity to leverage their existing expertise while expanding into a massive new market. Additionally, the data collection and ecosystem integration possibilities align perfectly with their existing business models.

What happened to Apple’s car project, and why did it fail?

Apple’s Project Titan, which ran from 2014 to 2024, was cancelled despite billions in investment and thousands of employees. The project faced numerous challenges including leadership changes, shifting goals (from fully autonomous to driver assistance), manufacturing complexities, and regulatory hurdles. Unlike software products, cars require massive physical manufacturing capabilities, supply chain management, and regulatory compliance that proved difficult even for Apple. The company ultimately decided to redirect resources to AI development rather than continue the automotive venture.

Should consumers be concerned about privacy and data collection in cars made by phone companies?

Yes, there are significant privacy implications. Phone companies already collect extensive data about digital behaviors, locations, and preferences. Cars add another layer of data collection including driving patterns, destinations, passenger conversations, and potentially biometric information. Unlike traditional automakers who focused primarily on transportation, tech companies have business models built around data monetization. This creates unprecedented opportunities for surveillance and behavioral analysis, raising important questions about privacy, data ownership, and corporate power over personal mobility.